Posts

For each and every customer is different and you will machine is always to learn how to price realize them. Particular users wish to be pampered, some customers need limited solution, and some consumers would like to be left by yourself to love their buffet. The brand new reduced server discover ways to comprehend their customers, the greater their tips will be. A warehouse supervisor generating $60,100 with $ten,000 within the overtime you are going to shave a couple thousand dollars from other government tax bill. A hotel bartender to make $forty-five,one hundred thousand in addition to $5,one hundred thousand in the information could get back all the federal taxes withheld using their info. The new income tax crack tunes universal, nonetheless it’s slanted on the center- and higher-money earners — professionals who are obligated to pay adequate government income tax to the write-offs to build a genuine difference.

Business

The brand new deduction are shorter by $one hundred per $step one,one hundred thousand you have made more than https://happy-gambler.com/bubble-craze/rtp/ you to limitation. “It could be really plausible if you ask me which they might straight down the cost of a great haircut, however, claim that they expect the tips to increase. We’re going to see in years into the future if it happens.” “The main one Big Stunning Expenses Work ‘s the concept of claims made and claims left,” he told you inside the declaration to help you NPR Thursday. “There’s no spin for the person suffering they have been leading to,” Horsford said in the a statement Thursday.

- When host repeat sales, customers subconsciously believe the fresh machine is more including him or her than just not.

- ◾ Calculating info with charges, for example a charge card processing fee, included.

- The next time somebody indicates doing something that you experienced tend to decrease your notice-confidence, respectfully decline.

- “The brand new doubt that is included with 2nd-speculating on your own features one another external and internal consequences,” explains Hannah Owens, LMSW.

- Learn the methods to such concerns and much more that have Mindset Now.

- President Trump’s hope to avoid federal tax to the worker tips will become possible Friday as he cues the new enormous budget bundle on the laws.

What’s a buyers doing?

Women machine wear one thing inside their hair for example a rose or barrette have a tendency to discover high info as well! You to definitely cause for then it the truth more glamorous women usually get more resources, and you may both men and women, surprisingly enough, discover females having trinkets inside their locks more attractive. In terms of tipped professionals, simply 4 million pros, otherwise dos.5% of your You.S. employees, stored work where information are all inside the 2023, according to a diagnosis because of the Yale Budget Laboratory. Of those, from the sixty% away from households which have tipped pros perform found a cut, with regards to the Income tax Rules Cardiovascular system, amounting to help you in the $step one,800 for each and every home per year. Watson along with listed that lots of tipped professionals keep numerous efforts. He warned these types of specialists you to simply $25,100000 of their yearly info was tax free — actually round the numerous tipped work.

Has social networking created the best ‘age away from envy’?

If you can’t manage sometimes, avoid attracting bugs by continuing to keep the area around the window ebony. Benefits we spoke to say it you are going to imply a little more within the specialists’ purse at the conclusion of the year. Although this you’ll give some save so you can tipped professionals, it may not become a serious matter. Here’s just what tipped specialists would like to know in the Zero Taxation for the Information as well as how this may apply to your. Intrinsic determination, where joy try inherent on the performance of the act, and you may included inspiration, where act is part of on your own-name, is the high types of inspiration. So that you probably feel great and you will came across after you focus on something that you love otherwise when you focus on some thing important to your.

Routine against several of your anxieties one to stem from a lack out of mind-trust. For many who’re also afraid your’ll embarrass oneself otherwise believe you’re gonna screw up, are anyway. The good news is, there are some ways you can improve your thinking-rely on.

Go the extra mile to help make Reciprocity

Thanks to a direct effect titled diffusion out of obligations, different people thinks they’s maybe not their job to help. Regarding a cafe or restaurant they feel it’s not as a result of these to log off a decent tip since the other people on the group will do it. In contrast, this will depend on the type of restaurant your’re also employed in. In one single study, from the International Home from Pancakes inside the Columbus, Kansas, the fresh groups didn’t suggestion better – 11% information weighed against 19% at the dining tables for starters. However, at the classier Smuggler’s Inn maybe not at a distance, communities had been exactly as nice while the singles and you can couples. People fight with confidence issues at one time or any other.

Continue Dogs Fit on the go

And the a lot more envy he’s, the newest worse they feel from the on their own. Do you evaluate your looks to people you follow on Instagram? Public evaluation idea demonstrates to you you to definitely and then make contrasting is natural. We most likely want to be a little more pretty sure.

Other ways to increase Tips

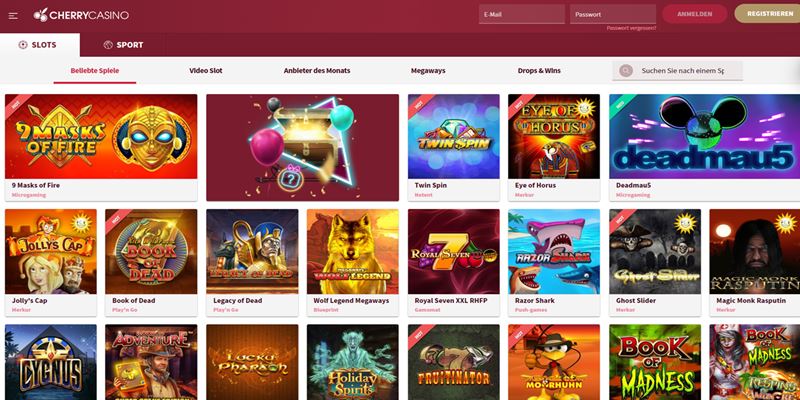

![]()

Come across the Cookie Rules, Rss feed Terms of service, Articles Plan, Advertising Alternatives, Don’t Offer My personal Information, and you can California Find from the Range during the Confidentiality Observe. The newest work is determined in order to expire inside 2028 but believes it will likely be restored because of its popularity, according to Jessica Lopez, chair of your Maryland Organization from CPAs’ Condition Taxation Panel. Two separate bills had been advised in the Maryland legislature earlier this year you to definitely handled a good statewide No Income tax to your Info Work. But both bills died after budget issues and too little appetite to check out up on the situation, according to Meyer.