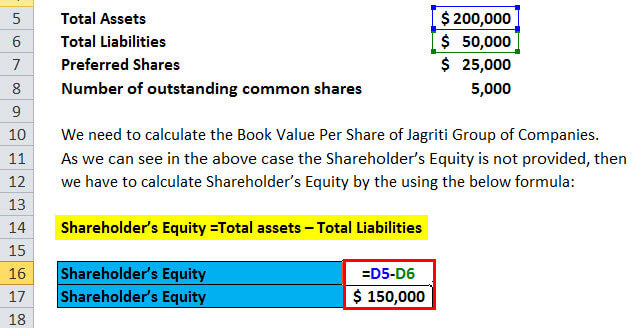

BVPS relies on the historical costs of assets rather than their current market values. This approach can lead to significant discrepancies between the book value and the actual market value of a company’s assets. Over time, the historical cost basis may not reflect the true worth of assets due to inflation, depreciation, and changes in market conditions, leading to potential misvaluation of the company’s stock. In this example, we have considered two main sections of the balance sheet – Assets and Liabilities.

Limitations of BVPS

Because book value per share only considers the book value, it fails to incorporate other intangible factors that may increase the market value of a company’s shares, even upon liquidation. For instance, banks or high-tech software companies often have very little tangible assets relative to their intellectual property and human capital (labor force). Book value per share is just one of the methods for comparison in valuing of a company. Enterprise value, or firm value, market value, market capitalization, and other methods may be used in different circumstances or compared to one another for contrast. For example, enterprise value would look at the market value of the company’s equity plus its debt, whereas book value per share only looks at the equity on the balance sheet. Conceptually, book value per share is similar to net worth, meaning it is assets minus debt, and may be looked at as though what would occur if operations were to cease.

Book Value: Meaning, Formula, Calculation and Examples

Another way to increase BVPS is for a company to repurchase common stock from shareholders. Assume XYZ repurchases 200,000 shares of stock, and 800,000 shares remain outstanding. Closely related to the P/B ratio is the price-to-tangible-book value ratio (PTVB).

Managing Assets and Liabilities

The market value is determined by the stock’s current market price, which can fluctuate based on supply and demand in the stock market. A part of a company’s profits may be used to purchase assets that raise both common equity and BVPS at the same time. Alternatively, it may utilize the money it takes to pay down debt, increasing both its common equity and its book value per share (BVPS). A second method to boost BVPS is by repurchasing common stock from existing owners, and many businesses utilize their profits to do so. Book value per share (BVPS) is calculated as the equity accessible to common shareholders divided by the total number of outstanding shares. This number calculates a company’s book value per share and serves as the minimal measure of its equity.

How to Calculate Book Value Per Share

For value investors, this may signal a good buy since the market price generally carries some premium over book value. Price-to-book (P/B) ratio as a valuation multiple is useful when comparing similar companies within the same industry that follow a uniform accounting method for asset valuation. It can offer a view of how the market values a particular company’s stock and whether that value is comparable to the BVPS. For companies seeking to increase their book value of equity per share (BVPS), profitable reinvestments can lead to more cash. In return, the accumulation of earnings could be used to reduce liabilities, which leads to higher book value of equity (and BVPS).

Formula and Calculation of the Price-to-Book (P/B) Ratio

High-growth companies often show price-to-book ratios well above 1.0, whereas companies facing financial distress occasionally show ratios below 1.0. Another valuable tool is the price-to-sales ratio, which shows the company’s revenue generated from equity investments. The P/B ratio can also be used for firms with positive book values and negative earnings since negative earnings render price-to-earnings ratios useless. There are fewer companies with negative book values than companies with negative earnings.

- This means that, in the worst-case scenario of bankruptcy, the company’s assets will be sold off and the investor will still make a profit.

- The P/B ratio also provides a valuable reality check for investors seeking growth at a reasonable price.

- Increasing book value per share can be done in two ways; however, sound strategies are required for both in order to avoid a financial fallout.

- However, some value investors may often consider stocks with a less stringent P/B value of less than 3.0 as their benchmark.

If the BVPS increases, the stock is perceived as more valuable, and the price should increase. It compares a share’s market price to its book value, essentially showing the value given by the market for each dollar of the company’s net worth. Overvalued growth stocks frequently show a combination of low ROE and high P/B ratios. This means that the market price of the company’s shares is 1.5 when is the earliest you can file your tax return times higher than its book value per share. Investors can use this ratio to assess whether the stock is trading at a premium (P/B ratio above 1) or a discount (P/B ratio below 1) relative to its BVPS. Book value is the amount found by totaling a company’s tangible assets (such as stocks, bonds, inventory, manufacturing equipment, real estate, and so forth) and subtracting its liabilities.

We’ll assume the trading price in Year 0 was $20.00, and in Year 2, the market share price increases to $26.00, which is a 30.0% year-over-year increase. The book value of equity (BVE) is the value of a company’s assets, as if all its assets were hypothetically liquidated to pay off its liabilities. Therefore, value investors typically look for companies that have low price-to-book ratios, among other metrics. A high P/B ratio can also help investors identify and avoid overvalued companies. Investors find the P/B ratio useful because the book value of equity provides a relatively stable and intuitive metric they can easily compare to the market price. Due to accounting procedures, the market value of equity is typically higher than a security’s book value, resulting in a P/B ratio above 1.0.

Therefore, the book value per share (BVPS) is a company’s net asset value expressed on a per-share basis. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

It represents the net asset value of a company’s shareholders’ equity, and it’s calculated by dividing the total shareholders’ equity by the total number of outstanding shares. The book value per share (BVPS) ratio compares the equity held by common stockholders to the total number of outstanding shares. To put it simply, this calculates a company’s per-share total assets less total liabilities. The book value per share (BVPS) metric helps investors gauge whether a stock price is undervalued by comparing it to the firm’s market value per share. BVPS is what shareholders receive if the firm is liquidated, all tangible assets are sold, and all liabilities are paid. Commonly used by stock investors and analysts, the Book Value Per Share (BVPS) metric looks at a company’s stock price to determine whether it’s undervalued compared to the stock’s current market price.

EPS, or earnings per share, measures net income as a percentage of a company’s outstanding shares. Stockholders’ equity is represented by book value per share, which may be seen at the top of this page. If the company’s BVPS increases, investors may consider the stock more valuable, and the stock’s price may increase. On the other hand, a declining book value per share could indicate that the stock’s price may decline, and some investors might consider that a signal to sell the stock. If a company has a book value per share that’s higher than its market value per share, it’s an undervalued stock. Undervalued stock that is trading well below its book value can be an attractive option for some investors.